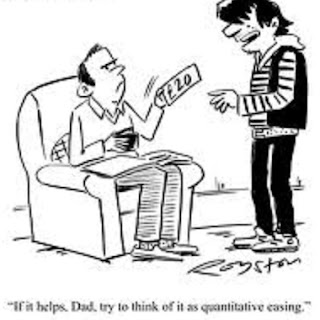

Everyone in the western world is doing some form of Quantitative Easing which basically is a fancy 25cent word to describe creating money out of thin air, backed by nothing tangible to be pumped into a financial sector that without such funding, would be the equivalent of a wretched, dying animal gasping for last breath as maggots circle about.

And when it comes to the financial industry-- Deservedly so.

Great Britain did it last month.. again. The Bank of England extended the program in February 2012 by £50bn ($79.58 bn US), taking the total size of QE to £325bn ($517.23 bn). And what was the end result besides interest rates at 0.5%? An unemployment rate of 8.4%. The headline from The Guardian UK, Feb 15th says it all-- "UK unemployment stuck at 17-year high as economy flatlines"

The European Union does QE too.. We wrote last week that basically the Fed and the ECB did a 'swap' of euros to dollars in the form of a loan as a condition to build up its firewall to the blowback which will come once Greece is forced to default on the 20th of March. This cash inflow allowed the bank today to 'lend' about half a trillion euros to 800 European banks which are still 100% dependent on this money to survive, while of course pretending to the general populace, they're strong and sound.

Now onto the good ole' USA. Bernanke spoke before Congress as he's required to do every month and announced...

No QE3... yet.

Gee, that's strange... wonder why?

Well the long and short of it is, QE is injected when the economy both is bad in a real sense and more importantly Appears outwardly bad enough to affect the market adversely and for everyday people to feel discouraged. So what do we have now? Well the economy is still very, very bad in reality. Problem for 'Bastard' Ben.. the perception is things are improving.

See, in 2009 through 2011, the economy was manipulated by the Fed and Treasury to appear we were in recovery due to intervention, so no one would get too upset as all the money was being funneled up to the very top 1%. Without the Fed and Treasury saving the day, where would we mere mortals be??

In 2012, its being manipulated by political pressures, which are entirely different. Those involve a particular incumbent desperate to be re-elected by fudging every meaningful statistical economic barometer to give the impression of improvement on his watch though he's made things worse in reality.

For instance, the Fed pretended it wanted lower unemployment, but really it was quite happy to see figures in the 9-10% range.. gave good political cover to issue QE 1, 2 and 'Operation Twist'.. But now?

Well the Bureau of Labor Statistics skewed its figures back in January down a full percentage point based on a statistical alteration of treating millions of unemployed people too discouraged to look for work as magically Not unemployed. So the media blasts 8.3% unemployment as 'wonderful news!' and most simple people accept it as so,

Then, as we discussed yesterday, the Consumer Confidence board stated after surveying 5,000 people out of a population of 310 million, that the confidence of the US shopper is on the rise by a large margin, which helped buoy the stock market to 13,000 for the first time since 2008 (Of course it dropped 50pts today on the news that no more free Fed money was coming down the pike anytime soon...)

So where do things stand? No QE 3..yet. Bernanke wants it. The banks want it. The financials.. the traders.. the investors.. the rats n' the roaches.. they all want it.. Expect it.

So if you lived in the world of the financial power elites, how do you ensure you get QE3? Well you start by selling stocks...100pt drop here, 200 pt drop there... you show a pattern of unsustainability in the market; you create a mild form of fear that things will get worse without more injection of capital.

Next you contact all your 'bosom buddies' in the corporate shill media and you instruct them to hold off the pollyanna headlines for a few weeks. Perhaps they do some stories about people on food stamps or families struggling to keep their home.. pull on some heart strings, as only the TV can do. Whatever it takes to create a mood of unease yet everything Must be within the framework of a "recovery"..

After maybe a period of 4-6 weeks of this, it would allow Bernanke to release another trillion (maybe two.. maybe three) into the financial sector. Already given them $7 trillion.. what's a few more? Its never going to be repaid.. never was meant to... money in a hole to keep the financial industry breathing while no one does anything to fix the situation or deter bad financial behavior.

This game will never ever stop. There's no political will for it to, and people can't vote out a Fed Chair. In fact, when a President chooses a nominee to run the Fed, they provide the list of candidates-- the President must choose one name off it. That's why so many Fed chairs end up serving both Democrat and Republican Presidents. Talk about being in lockstep!

The only real chance to stop Fed spending outside of magically passing legislation to break up the Fed, is when the time comes, enough Senators have the courage and guts to not support a debt ceiling increase. That stops the funnel of money instantly.

We hate being such 'Debbie Downers'.. Just giving people a view into the future. One does not have to be Nostradamus to see what to expect in March and April. Remember folks, nothing the Fed does is for your behalf, and if you do ever benefit from their policies, oh its quite unintentional.

Wednesday, February 29, 2012

Tuesday, February 28, 2012

Consumers 'Confidently' in La-La land

If there is one economic statistic more meaningless and distorted than all others (even the Bureau of Labor Statistics' definition of 'unemployed'), it is the Consumer Confidence Index.

Every month the Consumer Confidence Board trumpets its findings and if its positive, it gives the rats and roaches on Wall St motivation to invest more and lying, disingenuous politicians the 'ammunition' to continually declare we're in recovery instead of Admit we're in year 5 of a depression.

Today, the Board proudly stated that US consumer confidence went up to 70.8 compared with 61.5 in January, noting in its official release that, "Consumers are considerably less pessimistic about current business and labor market conditions than they were in January. And, despite further increases in gas prices, they are more optimistic about the short-term outlook for the economy, job prospects, and their financial situation"

Hmm...

Let's put aside the fact that consumer confidence in April 2007, when the economic downturn first began was 106.3, Do you know how the Board comes up with its findings?

The Board takes surveys via telephone to ask people who don't seem to mind being disturbed during the dinner hour, their views of the economy. And do you know how many people they poll to get an accurate barometer of the mood of 310 million people?

5,000 people.

And though their monthly findings are released at the end of each month, do you know when the cut off date is to compile their survey, released today the 28th?

February 15th.

Now why is that date important? Well for instance, the price of gas has gone up 18cents a gallon in the last 14 days. Today is the 28th of February. Two weeks ago was the 14th. The price increases were not felt at the time of their meaningless survey as they are now. This means, with no evidence gas prices are going down anytime soon, consumer confidence would not be as high today as it would, say on February 10th.

So let's break down where the economy really is:

* New orders for durable goods fell in January 2012 by 4%-- the largest drop in Three years. Durables are usually a key indicator of how happy people are to spend big bucks on things (cars, homes, jewelry...) They are a True reflection of consumer confidence.. or lack of it.

* Case-Schiller index shows for eight consecutive months, house prices are Dropping, even with interest rates exceptionally low to entice people to get into 30years of debt, um.. I mean a mortgage.

When 49 attorneys generals got together recently to settle with banks on robo-signings and other unscrupulous practices (which banks always do), beyond the financial settlement which most of it being paid by Freddie & Fannie Mae (the taxpayers), it meant hundreds of thousands of homes in limbo could now be free to put up for sale on the market. And basic economics teaches you, the greater the supply, the less the demand and the less the buyer has to pay to acquire.

Ergo, home prices are going to keep dropping as sellers compete with banks trying to liquidate their newly foreclosed properties... Guess who can afford to go lower?

* People are using the credit cards again and its not to buy luxuries. From the New York Post:

"More American households are falling back into the debt hole — this time without the safety net of home values to help bail them out. Last year, total US consumer debt reached the highest point in a decade, according to a credit-card industry observer... In December, the total consumer debt, which is the combination of non-revolving and revolving debt, rose by some 9.3 percent to $2.498 trillion, according to the latest Federal Reserve Board numbers."

Continued from the NY Post article: "Both revolving debt and non-revolving debt increased. Revolving debt, which is credit-card debt, went up by 4.1 percent. Non-revolving debt, which includes loans for cars and education, rose 11.8 percent, the central bank’s report said... In a weak economy with high unemployment, many people with big card balances become vulnerable to financial catastrophe."

Nice to see One US newspaper openly acknowledge the economy is weak and unemployment is high.

And speaking of debt, do you know what the total US consumer debt is?

~ $2.48 trillion, the highest total in a decade.

And the total for US student loan debt?

~ Close to $1 trillion.

And how much has the government spent since 2008 to prop up banks, financials and buoy the stock market artificially?

~ $7 trillion.. enough to pay off the Entirety of US consumer and student loan debt, with $3.5 Trillion left over...

As an aside: Why parents are still pushing their kids to go to college today, we'll Never understand. Don't you people understand it is the one debt that can not be erased in a bankruptcy?! Unless you die or permanently disabled, it stays with you Forever! A young person becomes a debt slave at 18years old-- how cruel a punishment is that to push on your son or daughter, just so they become Another doctor, lawyer or Wall St rat.

* Savers continue to be killed with the one hundredth of one-percent interest collected on their money. And they're the lucky ones. Many have tapped out their savings over the last 48 months in the hope they could ride things out until the economic climate truly continue getting better.

And this notion of job creation-- where is it coming from?

It was announced last week, the Postal Service plans on cutting 35,000 jobs. Newly bankrupt American Airlines plans to lay off 2100 workers. IBM will be laying off 1000 workers. Then there's people working in government jobs on state and local level.. teachers, police, firefighters.. all laid off due to budget cuts... Where do these people find work-- McDonald's?

So honestly.. Why the Fuck would anyone feel More optimistic today than last month? Why would anyone truly believe things are getting better for the nation? Because the Dow is hovering at 13,000?? Because corporate profits have never been greater than since this depression began??

Our only reasonable guess why consumer confidence went up in February is that the Board was fortunate enough to poll 5,000 utter imbeciles who are too tired, busy and/or lazy to care about life outside of themselves.

Every month the Consumer Confidence Board trumpets its findings and if its positive, it gives the rats and roaches on Wall St motivation to invest more and lying, disingenuous politicians the 'ammunition' to continually declare we're in recovery instead of Admit we're in year 5 of a depression.

Today, the Board proudly stated that US consumer confidence went up to 70.8 compared with 61.5 in January, noting in its official release that, "Consumers are considerably less pessimistic about current business and labor market conditions than they were in January. And, despite further increases in gas prices, they are more optimistic about the short-term outlook for the economy, job prospects, and their financial situation"

Hmm...

Let's put aside the fact that consumer confidence in April 2007, when the economic downturn first began was 106.3, Do you know how the Board comes up with its findings?

The Board takes surveys via telephone to ask people who don't seem to mind being disturbed during the dinner hour, their views of the economy. And do you know how many people they poll to get an accurate barometer of the mood of 310 million people?

5,000 people.

And though their monthly findings are released at the end of each month, do you know when the cut off date is to compile their survey, released today the 28th?

February 15th.

Now why is that date important? Well for instance, the price of gas has gone up 18cents a gallon in the last 14 days. Today is the 28th of February. Two weeks ago was the 14th. The price increases were not felt at the time of their meaningless survey as they are now. This means, with no evidence gas prices are going down anytime soon, consumer confidence would not be as high today as it would, say on February 10th.

So let's break down where the economy really is:

* New orders for durable goods fell in January 2012 by 4%-- the largest drop in Three years. Durables are usually a key indicator of how happy people are to spend big bucks on things (cars, homes, jewelry...) They are a True reflection of consumer confidence.. or lack of it.

* Case-Schiller index shows for eight consecutive months, house prices are Dropping, even with interest rates exceptionally low to entice people to get into 30years of debt, um.. I mean a mortgage.

When 49 attorneys generals got together recently to settle with banks on robo-signings and other unscrupulous practices (which banks always do), beyond the financial settlement which most of it being paid by Freddie & Fannie Mae (the taxpayers), it meant hundreds of thousands of homes in limbo could now be free to put up for sale on the market. And basic economics teaches you, the greater the supply, the less the demand and the less the buyer has to pay to acquire.

Ergo, home prices are going to keep dropping as sellers compete with banks trying to liquidate their newly foreclosed properties... Guess who can afford to go lower?

* People are using the credit cards again and its not to buy luxuries. From the New York Post:

"More American households are falling back into the debt hole — this time without the safety net of home values to help bail them out. Last year, total US consumer debt reached the highest point in a decade, according to a credit-card industry observer... In December, the total consumer debt, which is the combination of non-revolving and revolving debt, rose by some 9.3 percent to $2.498 trillion, according to the latest Federal Reserve Board numbers."

Continued from the NY Post article: "Both revolving debt and non-revolving debt increased. Revolving debt, which is credit-card debt, went up by 4.1 percent. Non-revolving debt, which includes loans for cars and education, rose 11.8 percent, the central bank’s report said... In a weak economy with high unemployment, many people with big card balances become vulnerable to financial catastrophe."

Nice to see One US newspaper openly acknowledge the economy is weak and unemployment is high.

And speaking of debt, do you know what the total US consumer debt is?

~ $2.48 trillion, the highest total in a decade.

And the total for US student loan debt?

~ Close to $1 trillion.

And how much has the government spent since 2008 to prop up banks, financials and buoy the stock market artificially?

~ $7 trillion.. enough to pay off the Entirety of US consumer and student loan debt, with $3.5 Trillion left over...

As an aside: Why parents are still pushing their kids to go to college today, we'll Never understand. Don't you people understand it is the one debt that can not be erased in a bankruptcy?! Unless you die or permanently disabled, it stays with you Forever! A young person becomes a debt slave at 18years old-- how cruel a punishment is that to push on your son or daughter, just so they become Another doctor, lawyer or Wall St rat.

* Savers continue to be killed with the one hundredth of one-percent interest collected on their money. And they're the lucky ones. Many have tapped out their savings over the last 48 months in the hope they could ride things out until the economic climate truly continue getting better.

And this notion of job creation-- where is it coming from?

It was announced last week, the Postal Service plans on cutting 35,000 jobs. Newly bankrupt American Airlines plans to lay off 2100 workers. IBM will be laying off 1000 workers. Then there's people working in government jobs on state and local level.. teachers, police, firefighters.. all laid off due to budget cuts... Where do these people find work-- McDonald's?

So honestly.. Why the Fuck would anyone feel More optimistic today than last month? Why would anyone truly believe things are getting better for the nation? Because the Dow is hovering at 13,000?? Because corporate profits have never been greater than since this depression began??

Our only reasonable guess why consumer confidence went up in February is that the Board was fortunate enough to poll 5,000 utter imbeciles who are too tired, busy and/or lazy to care about life outside of themselves.

Re-post: Oil Barrels, rising gas prices & Why?

This is a reposting from last year.. actually its two repostings in one 'new' post because both are related to the current spike in gas prices that we're all dealing with Again!. The first part was written on March 8th, 2011 and deal with oil barrels, gasoline and the cost you and I pay vs. the profit margin of those who benefit from higher prices.

The second part was originally written on April 12, 2011 and addresses how the actions of the Fed, specifically 'Bastard' Ben Bernanke and his policy of devaluing the US dollar has contributed mightily then (and presently) to higher prices for fuel.

________________

From 3/8/11:

1) Lately the price of oil has been rising and you hear things like 'oil is now $107 per barrel'. So, how many gallons of oil make up a 'barrel'? Choices are:

The second part was originally written on April 12, 2011 and addresses how the actions of the Fed, specifically 'Bastard' Ben Bernanke and his policy of devaluing the US dollar has contributed mightily then (and presently) to higher prices for fuel.

________________

From 3/8/11:

1) Lately the price of oil has been rising and you hear things like 'oil is now $107 per barrel'. So, how many gallons of oil make up a 'barrel'? Choices are:

A - 32 gallons

B - 42 gallons

C - 50 gallons

D - 56 gallons

Answer: B - 42 gallons of oil in a barrel

2) Now, since vehicles run on gasoline not oil, and the oil must be converted synthetically to make the fuel, how any gallons of gasoline does 1 barrel of oil make?

A - 55

B - 62

C - 77

D - 119

Answer: D - 119 gallons of gasoline are created from 1 barrel of oil

In simple math, if a barrel of oil is $107, then per gal, its 89.9 cents/gallon

"89.9 cents?!" you ask.. "Why am I paying $3.49+ at pump?!!"

Good question- Simple answer-- oil companies are Evil and they make sure they profit at every step of the oil to gasoline conversion process and the transportation from source of oil to the local gas pump. Investors and speculators are equally evil because their investment in the commodity drives up the price, but we'll address that in more detail in a future post...

Normally that would make the gasoline cost you about $2.70/gal (profit of about $1.90/gal to oil company). BUT you then have to add another 50-80 cents/gallon to cover all the federal, state, county and city taxes.. And that 89.9 cent gallon of gas is now $3.49 (or $3.79 for Premium)

Normally that would make the gasoline cost you about $2.70/gal (profit of about $1.90/gal to oil company). BUT you then have to add another 50-80 cents/gallon to cover all the federal, state, county and city taxes.. And that 89.9 cent gallon of gas is now $3.49 (or $3.79 for Premium)

_____________________

From 4/12/11:

There are two specific factors causing the rising cost of gasoline-

1) Federal Reserve's devaluing of the dollar, and..

2) Greedy, soulless commodities traders/investors.

Let's expand on these points a moment...

It has been stated repeatedly in this site that the Federal Reserve is intentionally devaluing (or weakening) the US dollar as a trading currency. This is is done so that American business can export their goods abroad and make a larger profit. The expansion of the US economy is Not based on the US consumer- he/she is tapped out; high debts, no credit, no jobs.. So US businesses need a weak dollar so other currencies, when strengthened, pay out a higher conversion rate.

To be clear, all nations are doing this, not just the US. There is a current race amongst all nations to see who can devalue their currency the quickest. It is ironic for instance that the US accuses China of currency manipulation when they themselves do the same thing.

And I state this often because it is very important to understand... it doesn't matter if it is the US Dollar, Japanese Yen or British Pound-- when a currency is devalued, it means it costs more to acquire the same goods/services as it did previously.

Now oil/petrol- the sale and value of the product, even amongst OPEC, is based on US dollars. It holds a certain value in relation to $1 and as that dollar is weakened, it takes more of those pieces of paper to match the amount of oil once purchased with only $1. So as the Fed is weakening the dollar via Quantitative Easing 1 & 2, to the tune of $2.5 Billion/day and excessive money printing, they are directly causing the price of oil to spike.

Those who sell us our oil are not going to lose monetary 'value' just because we are de-valuing our currency to help corporations export and to pay back our creditors with less...

Now let's look a moment on the commodities trader/investor. When gasoline is traded on the market floor, it is termed as "Brent Crude". Now as of this posting, the futures trading shows a Barrel of oil at $123.05. A commodities investor looks at oil and trades exactly as it would, say Pepsi or Coca-Cola on the stock exchange. It is an emotional science, often attached to panic buying and selling. The more they think it will rise, the more money that is put into the commodity which raises the price. And from there, those increased priced are immediately transferred onto the consumer.

So the fear/excitement of investors and devaluing of the dollar are the two major contributing factors to the increased rise in the price of gas.

There are two specific factors causing the rising cost of gasoline-

1) Federal Reserve's devaluing of the dollar, and..

2) Greedy, soulless commodities traders/investors.

Let's expand on these points a moment...

It has been stated repeatedly in this site that the Federal Reserve is intentionally devaluing (or weakening) the US dollar as a trading currency. This is is done so that American business can export their goods abroad and make a larger profit. The expansion of the US economy is Not based on the US consumer- he/she is tapped out; high debts, no credit, no jobs.. So US businesses need a weak dollar so other currencies, when strengthened, pay out a higher conversion rate.

To be clear, all nations are doing this, not just the US. There is a current race amongst all nations to see who can devalue their currency the quickest. It is ironic for instance that the US accuses China of currency manipulation when they themselves do the same thing.

And I state this often because it is very important to understand... it doesn't matter if it is the US Dollar, Japanese Yen or British Pound-- when a currency is devalued, it means it costs more to acquire the same goods/services as it did previously.

Now oil/petrol- the sale and value of the product, even amongst OPEC, is based on US dollars. It holds a certain value in relation to $1 and as that dollar is weakened, it takes more of those pieces of paper to match the amount of oil once purchased with only $1. So as the Fed is weakening the dollar via Quantitative Easing 1 & 2, to the tune of $2.5 Billion/day and excessive money printing, they are directly causing the price of oil to spike.

Those who sell us our oil are not going to lose monetary 'value' just because we are de-valuing our currency to help corporations export and to pay back our creditors with less...

Now let's look a moment on the commodities trader/investor. When gasoline is traded on the market floor, it is termed as "Brent Crude". Now as of this posting, the futures trading shows a Barrel of oil at $123.05. A commodities investor looks at oil and trades exactly as it would, say Pepsi or Coca-Cola on the stock exchange. It is an emotional science, often attached to panic buying and selling. The more they think it will rise, the more money that is put into the commodity which raises the price. And from there, those increased priced are immediately transferred onto the consumer.

So the fear/excitement of investors and devaluing of the dollar are the two major contributing factors to the increased rise in the price of gas.

Sunday, February 26, 2012

If enough say it, then perhaps it will happen...

A&G believes Greece should default.. shoulda' done it a long time ago.. been practically yelling from the rooftops for 18 months that it needs to happen. Of course if you read the previous post, "The Secret Plot to derail the Greek Bailout" (http://ants-and-grasshoppers.blogspot.com/2012/02/secret-plot-to-derail-greek-bailout.html), you'd know its going to happen soon, one way or another.

Back in the early days of Greek bailout, we were among a small fractional percentage of sites stating this view openly.

And now?

Well for curiosity and a bit of 'fun', we decided to keyword two phrases "Greece should default" and "Greece must default" in Google news to see what if anything would turn up. Here's just a sampling:

* "Greece should begin an "orderly" default and voluntarily leave the euro in order to escape a vicious cycle of insolvency, low competitiveness and ever-deepening depression -- Nouriel Roubini- Professor of Economics at New York University

* "The (Greek) economy continues shrinking and this makes it even more difficult to make revenue targets... There have been large increases in suicides and violent crime, and access to healthcare has declined... the default/exit option should be taken seriously for Greece " -- Center for Economic and Policy Research based in Washington, DC

* "This debt is unpayable... Greece should default, and default big. A small default is worse than a big default and also worse than no default.” -- Mario Blejer, who managed Argentina’s central bank in the aftermath of the world’s biggest sovereign default (2001) and also was an adviser to Bank of England Governor Mervyn King from 2003 to 2008

* "Why can’t we (Greece) default within the euro zone?... The only reason for taking on more loans is if we think that by doing that then we can repay them. We can’t and everybody knows that. The European Central Bank knows that. The International Monetary Fund knows that,” -- Yanis Varoufakis, Professor of Economics at University of Athens

* "The question for Greece is whether to continue its recent path - continued attempts at austerity, which do little to tame the deficit, followed by just enough bailout from the EU to avoid default - or whether to finally admit the obvious: it should default on its sovereign debt, abandon the euro, and go its own way." -- Jeffrey Miron, senior lecturer in economics at Harvard

* 'Why Greece should default and exit the euro' -- Telegraph UK headline

* 'Six reasons why Greece should default' -- Time Magazine headline

* 'Greece must default and quit the euro. The real debate is how' -- Guardian UK headline

* 'Greece must default if it wants democracy' -- Financial Times headline

~ Nice to see others join the the A&G bandwagon...

Friday, February 24, 2012

The secret plot to derail the Greek bailout

Warning: This is a very long post but a very important one to read...

** To break up a potentially long read, we have injected photos of butterflies, both because they are lovely to look at and they symbolize 're-birth' which is the grande theme of this post. We talk of Greece trying to prevent default... if it was a caterpillar, it would be like trying to prevent chrysalis.

So we begin..

There are two ways a corporation or nation defaults..

1) The corporation or nation openly declares bankruptcy

2) The corporation or nation does everything humanly possible to avoid it but powerful forces behind the scenes ensures it happens to their benefit

Greece should have taken option #1, for revenge sake

Instead in spite of public pronouncements and agreements to the contrary, they are being forced into option #2, and to be honest, we are unsure if the Greek leadership, much less the people even know or understand this...

We at A&G have done much research and have written extensively on this topic, not because our focus is usually Greek concerns or possess any ethnic or emotional ties to the country. We cover it because we see the default at minimum as the first 'Victory' in the war against banking and finance; the first Real and Genuine pain the financial elites will feel since September, 2008.

And when it comes, it will be long overdue.

As we said previously, we've done much study and there are two questions we couldn't fully understand in this geopolitical chess game- 1) Why was an agreement made in Brussels on Sunday night when many of the involved parties truly want Greece to default and be gone from the euro?, and 2) What role is the US playing, especially financially in this kabuki, especially since everyone knows the US bails out the world?

After reading an array of sources, we feel we finally have a much better understanding of the complex theater being enacted before our eyes and can piece together a timeline as to what has happened recently and what is going to occur over the next four weeks (Greece must pay its next installment of debts by March 20th- that is not a flexible date)

On Monday, January 16th, Presidential staff and Fed advisers convened with a dozen or more top Wall Street bankers. Its purpose was to brief a select group on the White House and Geithner approved operation to amputate the eurozone’s obviously gangrenous Greek leg.

Just 24 hours later, a remarkable undercover bailout slush fund was set up for the use of the ECB under Mario Draghi. On that day, the financial website Wealth Wire posted a piece suggesting the Fed was ‘up to something mysterious', and Jonathon Trugman of the New York Post’s financial desk wrote this: ‘Essentially, we just bailed out Europe’s banking system with the full faith and credit of the United States’.

Subsequently, a former Fed official told the Wall Street Journal that the Reserve was indeed bailing out Europe by operating in the shadows – aka a loan masquerading as a currency swap.

Former Vice President of the Federal Reserve bank of Dallas, Gerald O’Driscoll told the Journal:

“The Fed is using what is termed a “temporary U.S. dollar liquidity swap arrangement” with the European Central Bank (ECB). Simply put, the Fed trades or “swaps” dollars for euros. The Fed is compensated by payment of an interest rate (currently 50 basis points, or one-half of 1%) above the overnight index swap rate. The ECB, which guarantees to return the dollars at an exchange rate fixed at the time the original swap is made, then lends the dollars to European banks of its choosing.

The two central banks [ECB and US] are engaging in this roundabout procedure because each needs a fig leaf. The Fed was embarrassed by the revelations of its prior largess with foreign banks. It does not want the debt of foreign banks on its books. A currency swap with the ECB is not technically a loan.”

Well, swap or loan, it all went into the eurobank prop-up operation. During the period following that transfer, the ECB lent $483bn in various amounts to just over 500 banks in the eurozone.

So let's stop here and refresh what's happened so far- US taxpayer $$ has been used once again to bailout Europe's banks and financial institutions. If you ever wonder how the US has so much pull and sway in the UN and in economic, military and geopolitical affairs, perhaps this type of 'deal' answers it.

Let's continue..

That swap i.e. 'loan' deal was outlined to the key Wall St players on January 16th. In a nutshell, it was “We bale out the eurobanks for Mario, and in return they [the EU States] build a firewall around Greece”. It was the start of what became known as ‘amputate and cauterise’. Goldman Sachs played a pivotal role in the session.

The US view is this: Greece must default outside the euro, and become a leper. Secretary Geithner thinks the Europeans don’t have the money to make the banks ultra-safe…and that means an immediate contagion blowback to the US, with disastrous consequences. (It also means Obama's re-election chances are severely hindered if the US experiences anything close to another 'Lehman')

So we, the US, must covertly help the ECB render the eurobanks safe – and in return, they need to step up to the plate by leveraging whatever firepower they need to ensure the whole mess stops at Greece.

Simple.

The key players at this meeting were Timothy Geithner, Goldman Sachs' Lloyd Blankfein, a tight group of White House Obamites, Ben Bernanke (at “a safe distance”), Mario Draghi, and IMF boss Christine Lagarde. The President as well as Secretary of State, Hillary Clinton were fully aware of the meeting but neither attended.

As a consequence, from this point onwards Christine Lagarde began to play serious hardball about the need for a massive firewall investment by EU member States. Concurrently, Secretary Clinton applied every ounce of available pressure to the Sino-Japanese credit line as a potential further source of bricks in the wall.

Clinton’s State Department seems to have had some degree of success. Less so Lagarde: she has come up hard against Berlin’s refusal to expose Germany further.

The view in the Fed and Washington is that the Europeans are welching on the deal which is peculiar since really they never had Berlin on board in the first place. Germany does not want to expose themselves to even greater debt, and recently their legislative body enacted legislation prohibiting it. At the recent G-20 meeting, Lagarde has threatened to pull funding for the Greek bailout unless the IMF gets their way and a 750bil euro firewall is created.

So that's were things stand today, February 24th. Everyone wants a Greek default except for the 'chess piece' in the game that should have wanted it all along, and thus now is reduced its significance to that of scapegoat 'pawn' -- Greece.

And in case you think we didn't provide enough evidence to explain why Greece will be defaulting soon (even if it doesn't want to), here's a few more reasons:

* The credit rating agency S&P today joined Fitch and Credit Suisse in seeing the Greek Bailout as akin to 'default'. From appearances, it seems all will call default one second after the bond swap officially takes place. Whether that triggers CDS (credit default swaps) remains to be seen...

* The Greek consitutional change demanded by the Troika (to hierachise debt before other expenditure) will not be possible by the Greek bailout closure date. And they knew that all along.

* European creditor countries are demanding 38 specific changes in Greek tax, spending and wage policies by the end of this month and have laid out extra reforms that amount to micromanaging the country’s government for two years, according to the Financial Times. There is no way the Greeks will stand for that either. The program is being set up to fail, as many of these conditions will be impossible to achieve

* In an interview with the Wall Street Journal, Mario Draghi’s support for the deal remains understated bordering on tepid: he suggested that the sceptical market response to Tuesday’s rescue deal suggested many doubted Athens would follow through on a promised austerity cure. “It’s hard to say if the crisis is over,” he warned.

* Commerzbank AG Chief Executive Martin Blessing yesterday said of the Brussels deal, “The participation in the haircut is as voluntary as a confession during the Spanish Inquisition”.

In summary: If Greece does not default by March 20th, it will be an outright shock to A&G since so many major players in the secret contagion 'game' are working very hard behind the scenes to make sure it does happens. The goal is to cut off the financial bleeding at Greece before spreading to bigger and more important nations that require too much funding to bail, and because many believe they will be insulated by any financial blowback, thus the potential for a financial tsunami turning into a ripple.

We believe they are wrong on both accounts.

Thursday, February 23, 2012

Greek bailout update 2/23/11

We stated the other day that the G-20 meeting in Mexico may present itself as the first sincere and major impediment to all the corrupt leaders and bankers pushing the 2nd Greek bailout through.

A&G has made no secret we hope it fails and Greece defaults...

Bankers, financials and investors Must finally feel economic pain... Its been 40 months since Lehman Bros collapsed and all the economic powers of the world, mainly the US, did everything humanly possible (create $ out of thin air and give to evil banks) to protect them... It Must end at some point.

Here's more optimism that outcome will come about:

"Germany's ruling parties are to introduce a resolution in parliament blocking any further boost to the EU’s bail-out machinery, vastly complicating Greece’s rescue package and risking a major clash with the International Monetary Fund... The IMF has hinted it may cut its share of Greece’s €130bn (£110bn) package and warned that its members will not commit $500bn (£318bn) more in funds to ringfence Italy and Spain unless Europe beefs up its rescue scheme. " -- Telegraph UK

We've been burned so often on this issue.. The baddies always pull something out of thin air (or their asses) and 'win'... But at least as of today, it looks more promising of a Greek default than 4 days ago...

A&G has made no secret we hope it fails and Greece defaults...

Bankers, financials and investors Must finally feel economic pain... Its been 40 months since Lehman Bros collapsed and all the economic powers of the world, mainly the US, did everything humanly possible (create $ out of thin air and give to evil banks) to protect them... It Must end at some point.

Here's more optimism that outcome will come about:

"Germany's ruling parties are to introduce a resolution in parliament blocking any further boost to the EU’s bail-out machinery, vastly complicating Greece’s rescue package and risking a major clash with the International Monetary Fund... The IMF has hinted it may cut its share of Greece’s €130bn (£110bn) package and warned that its members will not commit $500bn (£318bn) more in funds to ringfence Italy and Spain unless Europe beefs up its rescue scheme. " -- Telegraph UK

We've been burned so often on this issue.. The baddies always pull something out of thin air (or their asses) and 'win'... But at least as of today, it looks more promising of a Greek default than 4 days ago...

Dow 13,000: April 2007 vs Today

~ April 23, 2007 New Yorker

And because the term 'trillion' gets so diluted in its meaning when its spoken of repeatedly, here's a very brief reminder of what a trillion dollars looks like:

$7,000,000,000,000 -- A '7' followed by 12 zeros

If the Fed had chosen to spend $7 Trillion dollars to bail out the American people instead of banks, financials, corporations and the stock market, every man, woman and child that make up the 310 million population, would have received $22,580 each.

Talk about Really stimulating the economy..

But let's move beyond that... let's do a little time travelling, back to when the stock market hit 13,000 for the first time ever (April 25, 2007) and do some compare/contrasting to see if things are truly better or not...

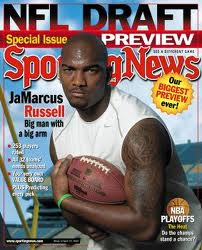

~ April 23, 2007 cover: JaMarcus Russell turned into a Big star didn't he?

_____

* Unemployment rate in April, 2007 was 4.5% with 6.8 million people without jobs.

In January, 2012, it was 8.3%.

Let's pretend for a moment the Bureau of Labor Statistics didn't purposely fudge the numbers by counting those given up looking for work as not unemployed, 'officially' 12.8 million Americans are out of work, an increase of 6 million people.

* Housing starts (building of new homes) was at 211,900 for April, 2007.

In January, 2012, the number was 197,900.

So 14,000 less homes are being built even though the US population grew by 8 million people in 4 years (302.2 mil people in '07; 310 mil. people in '11), and interest rates kept artificially low for an insane period of time.

* Consumer Confidence in April 2007 was listed at 106.3. CNN/Money at the time described the prevailing mood as "consumers shrugged off record high gasoline prices and falling home values, focusing instead on gains in the stock market and a strong employment picture."

January, 2012, Consumer Confidence was 61.1, which was down from 64.8 in December, 2011 and overall down a whopping 45.2 points from April, '07.

~ Time magazine US & Global cover, April 23, 2007 - pathetic I know...

* National average for gas price in April, 2007 was $3.11.

Today it is $3.59 according to Consumer Reports.

Filling a vehicle with 15 Gal/week for 52 weeks in April 2007 would have cost a driver around $2,425. Today if prices stayed as they are for a full 52 week year, the driver would pay around $2,800, an increase of $375 There goes that payroll tax cut savings...

* Average home price in April 2007 was $311,700 according to the Census bureau.

As of October, 2011, the average home price was $242,300, a drop in value of $69,400!! (22%) in a span of only 4.5 years.

____

I think you get the point...

So when you hear the media trumpeting terrible statistics as progress or 'recovery', try to put things in a more proper perspective..

So when you hear the media trumpeting terrible statistics as progress or 'recovery', try to put things in a more proper perspective..

And don't be celebrating Dow 13,000 too hard...

~ Amazingly, this was the cover on April 23, 2007, 18mths before election

Wednesday, February 22, 2012

Default looking more & more likely

Very brief post..

Its looking more and more like all those politicians, bankers & financiers who negotiated for 12 hours in Brussels for a 2nd Greek bailout basically wasted their time, because it is looking more and more like the March 20th default for Greece is still on, and perhaps, may occur even sooner, if all things progress without any more Insipid meddling...

"Fitch (credit rating agency) said it was downgrading Greece to “C” from “CCC,” and would follow up with further downgrade to a “restricted default” when the (Greek) bond swap is completed.’" -- Reuters

So what does that mean? The main bond swap is scheduled for March 10, and at that point, Fitch will name the event as a technical default. What is the ramifications for credit-swap insurance? That’ll depend on what deal, say, Hedge Funds have signed with specific insurers. But you could certainly speculate that some insurance will be triggered.

The downgrade is an early blow for those who put the Brussels accord together just 36 hours ago….and quite possibly a victory for others who always wanted it to fail.

Like us at A&G

Its looking more and more like all those politicians, bankers & financiers who negotiated for 12 hours in Brussels for a 2nd Greek bailout basically wasted their time, because it is looking more and more like the March 20th default for Greece is still on, and perhaps, may occur even sooner, if all things progress without any more Insipid meddling...

"Fitch (credit rating agency) said it was downgrading Greece to “C” from “CCC,” and would follow up with further downgrade to a “restricted default” when the (Greek) bond swap is completed.’" -- Reuters

So what does that mean? The main bond swap is scheduled for March 10, and at that point, Fitch will name the event as a technical default. What is the ramifications for credit-swap insurance? That’ll depend on what deal, say, Hedge Funds have signed with specific insurers. But you could certainly speculate that some insurance will be triggered.

The downgrade is an early blow for those who put the Brussels accord together just 36 hours ago….and quite possibly a victory for others who always wanted it to fail.

Like us at A&G

Tuesday, February 21, 2012

Another day in the Greek soap opera...

Another day in the Greek soap opera... A reason to 'Hope'.. yes we know we've pooh-pooh'd the term viciously in a precious post but cut us some slack at A&G... Monday was a depressing day.

Less than 24 hours ago, evil, self-centered Greek politicians worked in concert with European and global banking interests to destroy Greece once and for all via a 2nd bailout 'officially' at €130bn but really at €245bn.

Yes, Monday was a downbeat day to be sure... especially because banks, investors and the market were so upbeat on the news, and any time they're smiling, it must be something awful...

But, alas there's hope it will still unravel and Greece will default by March 20th:

"At a G20 summit in Mexico in two days the EU will plead for increased IMF contributions by non-euro countries to help shore up a eurozone "financial firewall" seen as vital to protecting Spain and Italy from Greek debt contagion. The IMF will refuse to make extra cash available to the EU and will threaten to pull the plug on its contribution to Tuesday's €130bn bailout of Greece unless the eurozone creates a €750bn fund, a move opposed by Germany...

"Germany has opposed previous calls to merge the two funds because it will increase Germany's liability and exposure to a eurozone default by 50pc, an issue that threatens a serious Bundestag backlash or revolt against Angela Merkel's effort to get agreement on more aid for Greece." -- Telegraph UK

We've all been down this road before, and the baddies seem to win so often that it seems foolhardy to get snookered in to all the day by day news... but even though we lampooned the word a few days ago, A&G is hopeful the bailout will be derailed and the financial world be Forced to swallow some very Bitter medicine starting in late March.

Less than 24 hours ago, evil, self-centered Greek politicians worked in concert with European and global banking interests to destroy Greece once and for all via a 2nd bailout 'officially' at €130bn but really at €245bn.

Yes, Monday was a downbeat day to be sure... especially because banks, investors and the market were so upbeat on the news, and any time they're smiling, it must be something awful...

But, alas there's hope it will still unravel and Greece will default by March 20th:

"At a G20 summit in Mexico in two days the EU will plead for increased IMF contributions by non-euro countries to help shore up a eurozone "financial firewall" seen as vital to protecting Spain and Italy from Greek debt contagion. The IMF will refuse to make extra cash available to the EU and will threaten to pull the plug on its contribution to Tuesday's €130bn bailout of Greece unless the eurozone creates a €750bn fund, a move opposed by Germany...

"Germany has opposed previous calls to merge the two funds because it will increase Germany's liability and exposure to a eurozone default by 50pc, an issue that threatens a serious Bundestag backlash or revolt against Angela Merkel's effort to get agreement on more aid for Greece." -- Telegraph UK

We've all been down this road before, and the baddies seem to win so often that it seems foolhardy to get snookered in to all the day by day news... but even though we lampooned the word a few days ago, A&G is hopeful the bailout will be derailed and the financial world be Forced to swallow some very Bitter medicine starting in late March.

Video: Understanding Greek bailout in 4min..

This post is on Greece but First thing First... The US media is Horrid!..

Dreadful and horrid..

Let's just state that upfront-- it is pro-corporation, pro-Wall St, constantly distorts truth to fit ideological purposes (whether it be Left v Right or USA #1) and will do everything in its power to brainwash every man, woman & child in believing in a faux 'recovery' with full credit given to the current President.

The US media refuses to cover the devastation and real-life suffering of this current depression-- those living in homeless shelters, tent cities or in their automobiles... the heavy dependence on government assistance-- food stamps, welfare, unemployment benefits, etc simply to scrape by.. the continual systematic destruction of the middle class... The US media shows None of it.

And when it comes to Greece, the only headline they wish to trumpet is that Greece got a second bailout i.e. problem solved, let the recovery commence.

For honest written journalism, we read British finance papers and the German publication, Spiegel. And for televised news, we much prefer Russia Today (RT)

The above video is 4:15 long. The interviewee is Rodney Shakespeare, a political analyst and professor of Binary Economics, and afterwards you should get a true understanding of where Greece and the rest of the world stands in terms of the Eurozone, global banking and how bad things are & continue to be for a nation that is for all intensive purposes, a colony.

If video doesn't show up or play, click link below:

http://www.youtube.com/watch?v=YnccQngx_AQ&feature=player_embedded

Dreadful and horrid..

Let's just state that upfront-- it is pro-corporation, pro-Wall St, constantly distorts truth to fit ideological purposes (whether it be Left v Right or USA #1) and will do everything in its power to brainwash every man, woman & child in believing in a faux 'recovery' with full credit given to the current President.

The US media refuses to cover the devastation and real-life suffering of this current depression-- those living in homeless shelters, tent cities or in their automobiles... the heavy dependence on government assistance-- food stamps, welfare, unemployment benefits, etc simply to scrape by.. the continual systematic destruction of the middle class... The US media shows None of it.

And when it comes to Greece, the only headline they wish to trumpet is that Greece got a second bailout i.e. problem solved, let the recovery commence.

For honest written journalism, we read British finance papers and the German publication, Spiegel. And for televised news, we much prefer Russia Today (RT)

The above video is 4:15 long. The interviewee is Rodney Shakespeare, a political analyst and professor of Binary Economics, and afterwards you should get a true understanding of where Greece and the rest of the world stands in terms of the Eurozone, global banking and how bad things are & continue to be for a nation that is for all intensive purposes, a colony.

If video doesn't show up or play, click link below:

http://www.youtube.com/watch?v=YnccQngx_AQ&feature=player_embedded

Grecian Soap Opera: As the World Yawns

Late last night (or very early this morning), the Eurozone and Greece's leaders after meeting for 12 hours, finally ended their little pow-wow essentially agreeing to cut the nation up into little pieces, once & forever killing off Greece as a democratic, sovereign nation.

And for all the things agreed upon which will undoubtedly turn investors, banks and other profiteers' tiny little willies into small chubbies in celebration of non-default (amazingly its been 40 months since Lehman Bros. and financiers have yet to suffer a genuine loss), here's the most important thing to take from the meeting:

"To make sure all goes smoothly, Big Brother will be watching. Permanently. The troika (made up of the ECB, IMF and EU), will have an "enhanced and permanent presence on the ground in Greece" to make sure the country holds up its end of the bargain." Telegraph UK

In other words, the technocrat, Papademos and the other Greek political filth were so eager beaver to get a financial aid package provided to them (which practically every penny goes to creditors and not the nation itself), that it declared April's elections to be mute, since a 'permanent presence' of banking technocrats will be running Greece's finances. And make no mistake, this economic colonization will last for decades if not forever since it will be forever and a day before Greece ever grows its economy again to productivity.

And if the Grecian people ever want their nation back, they better start channeling their violent passions not at local merchants and buildings, but at those specifically responsible for this shame. Last year it was Arab Spring. Now is the time for a Grecian Spring.

I still believe Greece will default in late March and trigger a much needed market correction. There's still too many variables at play and nations like Netherlands and Germany have been openly saying Greece should just default and leave the euro on its own. So still many twists and turns in this soap opera.

But for today.. Greece, you just Officially became a colony.

ΥΓΕΙΑ!! (Greek for 'Cheers!'; Phonetic Pronounciation: Yamas)

And for all the things agreed upon which will undoubtedly turn investors, banks and other profiteers' tiny little willies into small chubbies in celebration of non-default (amazingly its been 40 months since Lehman Bros. and financiers have yet to suffer a genuine loss), here's the most important thing to take from the meeting:

"To make sure all goes smoothly, Big Brother will be watching. Permanently. The troika (made up of the ECB, IMF and EU), will have an "enhanced and permanent presence on the ground in Greece" to make sure the country holds up its end of the bargain." Telegraph UK

In other words, the technocrat, Papademos and the other Greek political filth were so eager beaver to get a financial aid package provided to them (which practically every penny goes to creditors and not the nation itself), that it declared April's elections to be mute, since a 'permanent presence' of banking technocrats will be running Greece's finances. And make no mistake, this economic colonization will last for decades if not forever since it will be forever and a day before Greece ever grows its economy again to productivity.

And if the Grecian people ever want their nation back, they better start channeling their violent passions not at local merchants and buildings, but at those specifically responsible for this shame. Last year it was Arab Spring. Now is the time for a Grecian Spring.

I still believe Greece will default in late March and trigger a much needed market correction. There's still too many variables at play and nations like Netherlands and Germany have been openly saying Greece should just default and leave the euro on its own. So still many twists and turns in this soap opera.

But for today.. Greece, you just Officially became a colony.

ΥΓΕΙΑ!! (Greek for 'Cheers!'; Phonetic Pronounciation: Yamas)

Monday, February 20, 2012

Incompatibility- Democracy & Bailouts

About 3-6 months ago, former Greek Prime Minister Papandreou wanted to hold a national referendum to decide whether or not to accept the deep austerity which would be needed to secure the bailout funds from the EU, EBC & IMF troika; let the people vote.

Don't know if he was truly sincere or a political bluff to curry favor from the populace, but the European leaders were Horrified! Democracy?? People making such an important decision about their own country?? My God!! Sacre Bleu!!

Germany and France then set up emergency conference calls and meetings, turned the thumb screws pretty hard, and thus bullied & intimidated Papandreou to back off his referendum.

Fast forward to the present. Everyone knows Greece needs more money, the troika want more financial 'blood', and don't trust the Greeks to keep their word and implement the austerity they promise. Some Greek leaders have even publicly stated they agree now and after the April election, will re-negotiate terms.

This has Germany quite nervous and sickened... So what to do? Germany's Finance Minister Schauble has an idea: if Greece wants its money, then postpone elections...

"The German finance minister wants to prevent a “wrong” democratic choice. Similar to this is the suggestion to let the elections go ahead, but to have a grand coalition irrespective of the outcome. The eurozone wants to impose its choice of government on Greece – the eurozone’s first colony... It is one thing for creditors to interfere in the management of a recipient country’s policies. It is another to tell them to suspend elections or to put in policies that insulate the government from the outcome of democratic processes." -- Financial Times

Let's re-state this, because its truly important to understand: Germany wants Greece to either suspend their April elections because they're afraid the newly elected people won't do as they wish, or have elections that will be ultimately completely meaningless for the troika will appoint all members of a coalition, much in the same way they appointed the current technocrat (bank lackey) Papademos who is trying everything short of infanticide to force Greece to capitulate its autonomy and future as a nation.

Imagine if China, the 2nd biggest holder of US debt told us to postpone our elections or we wouldn't get any more money... just Imagine the reaction.. I don't even need to type it...

Greece needs to default.. now! Today.. No warnings.. no prior notice... Default and punish those who richly deserve financial pain-- banks, financials and investors.

Actually, the German Finance Minister really wants this as well:

"(Schäuble’s) preference is to force Greece into an immediate default... (the) proposal to postpone elections as a targeted provocation intended to illicit an extreme reaction from Athens. If that was the goal, it seems to be working... The German strategy seems to be to make life so unbearable that the Greeks themselves will want to leave the eurozone" -FT

The Greek people have taken a lot... how much more will they take?

Don't know if he was truly sincere or a political bluff to curry favor from the populace, but the European leaders were Horrified! Democracy?? People making such an important decision about their own country?? My God!! Sacre Bleu!!

Germany and France then set up emergency conference calls and meetings, turned the thumb screws pretty hard, and thus bullied & intimidated Papandreou to back off his referendum.

Fast forward to the present. Everyone knows Greece needs more money, the troika want more financial 'blood', and don't trust the Greeks to keep their word and implement the austerity they promise. Some Greek leaders have even publicly stated they agree now and after the April election, will re-negotiate terms.

This has Germany quite nervous and sickened... So what to do? Germany's Finance Minister Schauble has an idea: if Greece wants its money, then postpone elections...

"The German finance minister wants to prevent a “wrong” democratic choice. Similar to this is the suggestion to let the elections go ahead, but to have a grand coalition irrespective of the outcome. The eurozone wants to impose its choice of government on Greece – the eurozone’s first colony... It is one thing for creditors to interfere in the management of a recipient country’s policies. It is another to tell them to suspend elections or to put in policies that insulate the government from the outcome of democratic processes." -- Financial Times

Let's re-state this, because its truly important to understand: Germany wants Greece to either suspend their April elections because they're afraid the newly elected people won't do as they wish, or have elections that will be ultimately completely meaningless for the troika will appoint all members of a coalition, much in the same way they appointed the current technocrat (bank lackey) Papademos who is trying everything short of infanticide to force Greece to capitulate its autonomy and future as a nation.

Imagine if China, the 2nd biggest holder of US debt told us to postpone our elections or we wouldn't get any more money... just Imagine the reaction.. I don't even need to type it...

Greece needs to default.. now! Today.. No warnings.. no prior notice... Default and punish those who richly deserve financial pain-- banks, financials and investors.

Actually, the German Finance Minister really wants this as well:

"(Schäuble’s) preference is to force Greece into an immediate default... (the) proposal to postpone elections as a targeted provocation intended to illicit an extreme reaction from Athens. If that was the goal, it seems to be working... The German strategy seems to be to make life so unbearable that the Greeks themselves will want to leave the eurozone" -FT

The Greek people have taken a lot... how much more will they take?

Saturday, February 18, 2012

ELE I love u . . .

Hi dear stylebookers. .Today I want to share my lovely and fashionable friend, Ele`s style..We study together in Azerbaijan State Academy of Arts..She is, interior designer..And very good painter :) Ok ...Dear readers she is very stylish..You'll see it:) Just look and enjoy...Bye..XAVER

I love u my dear friend...ELENA ♥

Subscribe to:

Posts (Atom)

.jpg)

.jpg)

.jpg)